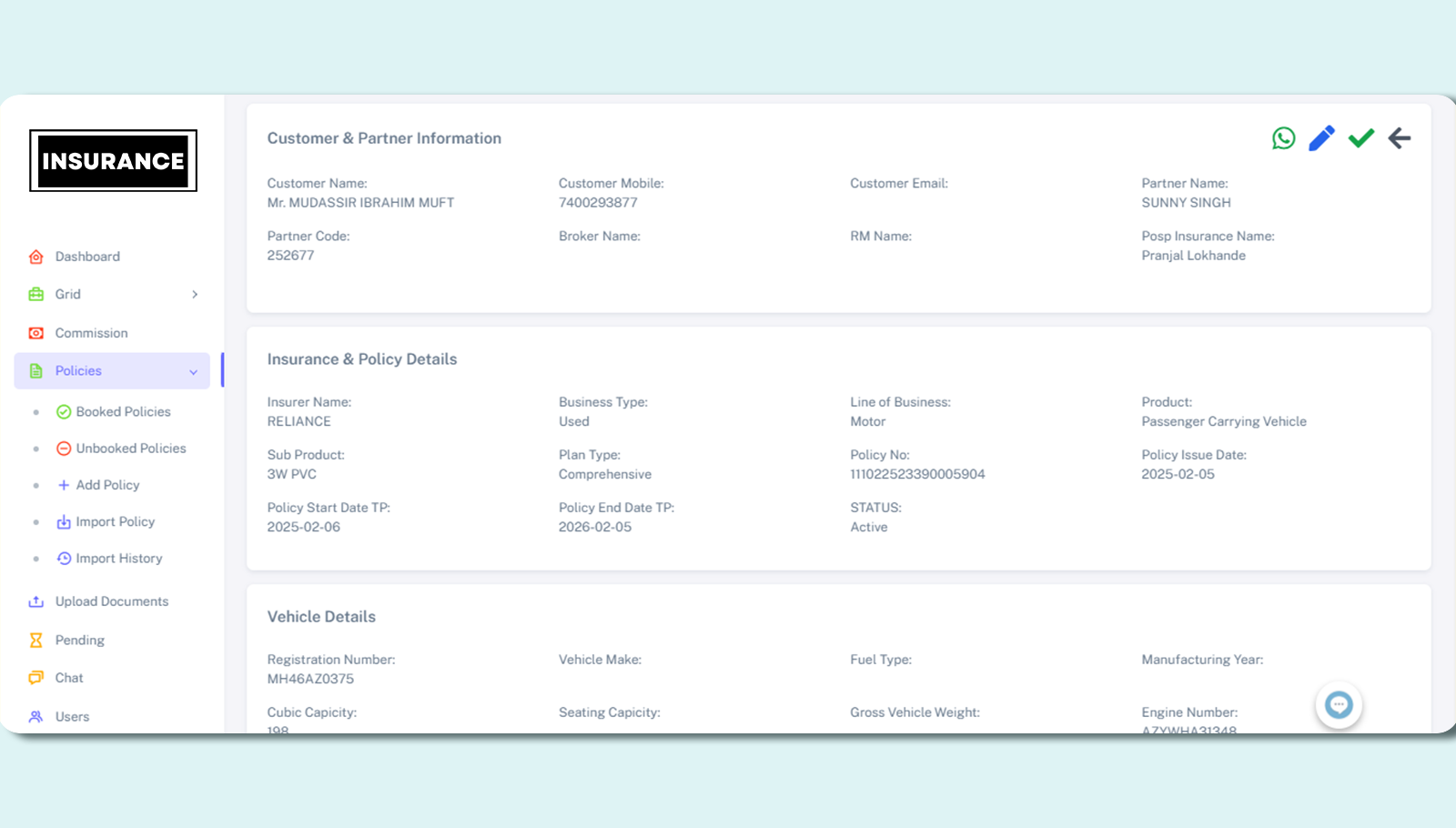

In the competitive world of insurance, keeping clients happy and staying organized is key. Our Insurance CRM is built to help you manage every aspect of your client relationships—from policy management and renewals to claims tracking and customer service.

Client Relationship Management

Build lasting relationships by having all client information at your fingertips.

- 360° Client View: Access a comprehensive profile for each client, including contact details, policy history, communication logs, and service requests.

- Easy Communication: Store all client emails, calls, and messages in one place for quick reference and follow-up.

- Client Segmentation: Organize clients by policy type, coverage level, or other criteria to personalize your communication and service